Let's establish right off the bat a couple of the principles upon which RentConfident is founded. The first: policymakers have a faulty understanding of how complicated it is for renters to move. The second, which is informed by the first: home buyers have access to far more data about property on the market than renters do.

The folks who control access to important data have this far-fetched idea that renters can just up and leave a bad apartment on a whim, which in theory is true. They don't have to worry about selling the property when they're done with it. They don't have to worry about land values and estates. But there is still a high cost involved, one that can add up to the equivalent of three to six months of housing expenses added on to the annual budget just to cover moving to a new location. There are leases and utility contracts. If you have kids there may be new uniforms, new books, new commuting routes. That's not even getting into the extraordinarily complicated steps that must be taken when a government subsidized ("Section 8") tenant suddenly has to move.

This disconnect between policymakers and renters has led to some extreme shortcomings in the data department. As someone who has built a business around digging into the background of apartment buildings on behalf of renters, I can 100% verify that the absence of renter access to certain chunks of information is blatantly apparent. These are pieces of information that are available, assembled, and even accessible to buyers, but completely blocked off to renters. In some cases the access is barred by company policy. In others it's because of the very short time frame renters have to choose an apartment when compared with buyers, who can remain under contract for up to a couple of months while lawyers and home inspectors do the research on their behalf.

To clarify what I mean, here are three examples of data sources that really should be made accessible to renters.

LLC Cross Indexing

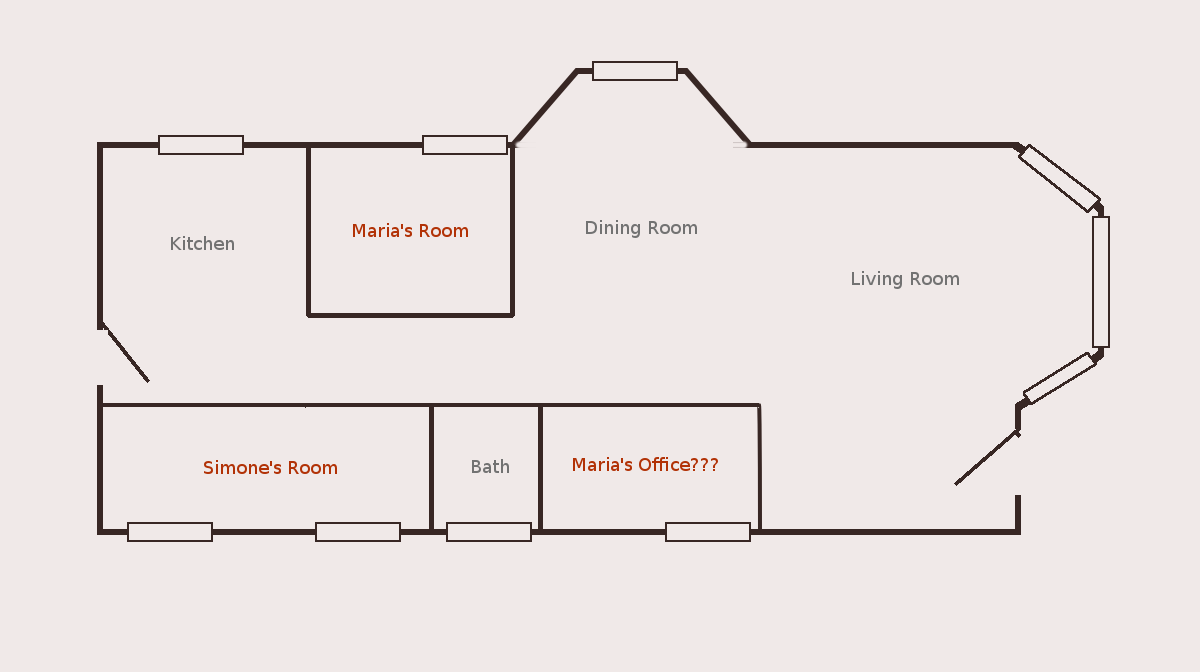

It is certainly useful landlords to incorporate. Many do so as "Limited Liability Companies" or LLCs. Landlords who choose to incorporate as LLCs for their building purchases are usually doing so to protect their portfolio from expensive lawsuits. If a landlord holds a portfolio of, let's say 50 buildings, and buys them all in their own name or in the name of an individual company, then the entire portfolio could theoretically be seized as collateral in a lawsuit. If, however, the landlord creates a separate LLC for each building and puts the name of the LLC on the title as owner, then any given liability lawsuit can only attach the building where the incident occurred. This is all quite practical on the surface.

Of course, this practice has its drawbacks, namely in how it complicates matters when someone on the outside - like a renter, a buyer, or a government inspector - is seeking to understand the scope of a single owner's portfolio. In late April the New York Times online ran a column by Emily Badger about nationwide problems with LLCs and owner anonymity. While many owners use LLC incorporation solely to protect their assets, others use it to launder money or as a way to quickly get out of a bad property without any fear of retribution.

In Chicago it is popular for owners to create a separate LLC for every building they purchase. Some of them register Illinois LLCs, others choose to incorporate in Delaware or Nevada. While you can look up the owner of an individual Illinois LLC on the Illinois Secretary of State's website, you can't reverse search to find all LLCs created by one individual. You can't even cross-index by address. Linking together all the individual shell LLCs that a single landlord uses is what takes the most time when we create our Signature Reports, adding anywhere from an hour to eight hours for a single report. In fact, it's so labor intensive that we had to create a separate version of our report for super large scale property owners like Loyola University, which limits the number of buildings we'll include in the report to 50. If we as a business specializing in apartment data assembly cannot connect the dots of an owner's portfolio in a reasonable amount of time, there is absolutely no way that an average renter would be able to do so in the time required to make a decision on an apartment.

It is important for renters to know who owns their housing. It's important for them to know the size of the landlord's inventory, and to look at all of their properties as a whole for recurring problems that could eventually crop up in their building as well.

While the Secretary of State does make their records available for purchase in bulk, the cost for a download runs in the five figure range or higher depending on how much data you want, and that's only for the first purchase and doesn't include the cost for regular updates. This means that only large scale operations like big law firms and city governments can obtain the raw information that would be needed to create a cross-index, and even then, they would still have to create some sort of computerized system to do the cross-indexing of the raw data once obtained from ILSoS.

The Illinois Secretary of State needs to step back and take a big picture view of how people use LLC ownership data. They need to redo their site to make it easier for the average citizen to track down this information. Delaware and Nevada should probably look into doing so as well, given how many people nationwide choose to incorporate in those two states.

CLUE Reports

In the world of non-government-affiliated data collection companies, there are few that rival LexisNexis in scope and size. They maintain records on any number of useful things, from lawsuits and credit to insurance. Every time something bad happens to you, there's probably a bean counter at a desk at LexisNexis HQ who ticks a little box on a form. Within their vaults is the data warehouse known as CLUE, the Comprehensive Loss Underwriting Exchange. Think of it like a credit report, but for insurance. CLUE exists for cars and property. If you get into a car accident your insurance company will add it to the CLUE report for your car. If a landlord files an insurance claim on their building, it goes into the CLUE report for that property, where it remains for seven years.

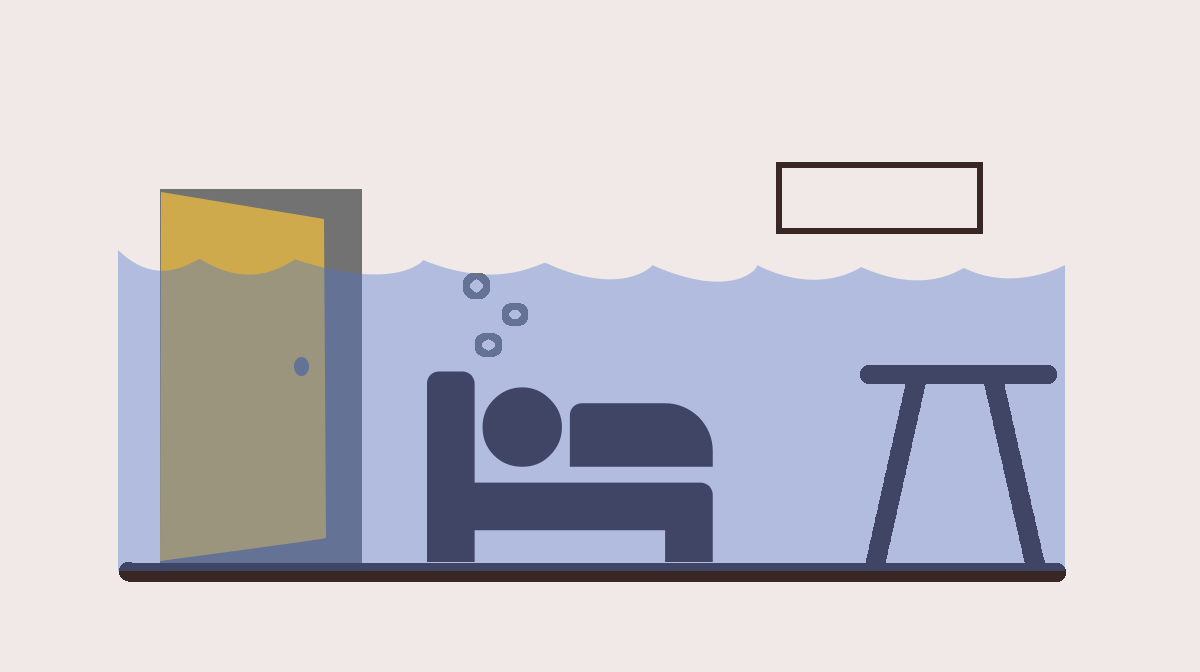

Now, I live in a neighborhood that tends to flood after heavy rains. Within two blocks of me there's a chunk of houses that all have been at least partially submerged in Chicago River flood water a couple of times in the past seven years. Many of those buildings have basement apartments. If I were looking at renting in this area I would definitely want to see the CLUE report for every building on my list. CLUE reports would contain record of any recent major disasters affecting the building that were severe enough to get the insurance companies involved, from fires and natural disasters to dog bites and slip & fall injuries.

CLUE was created to allow insurance companies to communicate between one another regarding the recent history of a property. Beyond that, CLUE reports are subject to the FACT act, which allows consumers to request one copy of their report every year. If you own a car you can request the CLUE report for that car. If you own a house, you can request the CLUE report for that house. (You can order yours here.) Buyers have recently been requiring sellers to provide CLUE reports as part of their purchase contracts. As a condo owner I had to obtain one for my building in order to apply for a condo owner's policy. But there is currently no trend or demand for landlords to provide CLUE reports to renters, even in an abbreviated format.

We think it would be fantastic if LexisNexis made a version of the CLUE report available to renters.

Commercial Sale Listings

This one speaks more to the Chicago market than the national market. Other areas are a lot more open about commercial listing info.

Suppose you order blue shoes online and get red ones instead by mistake. You'll probably send them back. If you rent an apartment from Mr. Blue and suddenly it is owned by Mr. Red, you'll probably wish you could send the apartment back as well.

Once upon a time, when a homeowner listed a property for sale, only the company that held the listing was allowed to promote it. It was the responsibility of agents to hustle and know prospective buyers and market that house to those buyers exclusively. Eventually the MLS came into being in the form of paper books that were delivered to brokerage offices on a weekly basis, compiling the listings of every participating brokage into one massive book.

These days the MLS is online. It powers listing aggregators like Zillow and Trulia along with every brokerage website. In most areas brokerages can only participate in their local MLS if they are members of their local Realtor association. In the greater Chicagoland area, residential agents are expected to join Realtor associations, but commercial agents - the ones who specialize in offices, warehouses, factories and apartment buildings - are not.

In Chicago, apartment buildings with four units or less are usually marketed through residential agents and larger buildings are marketed through commercial agents. This means that you can find a ton of little apartment buildings in the MLS but not many large apartment buildings.

The commercial equivalent of an MLS is a Commercial Information Exchange, or CIE. There are a few CIEs that are used in the Chicago area, namely CoStar (owner of Loopnet, Cityfeet, Apartments.com, and more) and ICEx. But commercial real estate mostly remains a walled garden, with individual commercial brokerages holding their listings close to their chests and only sharing them with their own buyer clients the old school way. Chances are if a property lasts on the market long enough to make it into a CIE, hundreds of prospective buyers have already seen it and taken a pass. There really is no way for a tenant to look online and find out if a specific apartment building is for sale.

I can understand why a landlord would not want their own tenants to know that their apartment building is for sale. Tenants tend leave if they know that an owner change is imminent. This is because new owners have a marked tendency to increase rents. There's also the issue of blockbusting, an illegal sales tactic that originated (unfortunately) in Chicago. It's a practice where agents scare white owners out of their homes at low prices by implying that minorities are about to move into the neighborhood. If a landlord or their agent tells their tenants that the building is for sale it could be seen as a form of blockbusting.

You will probably never see a for sale sign in front of an apartment building unless it is empty. Landlords who are otherwise completely honest and straightforward will still pull their best poker faced bluff if a tenant asks them, "is this building for sale?" Nope. No way. Never. Would never sell this building.

... Yeah, right.

There needs to be a way for tenants to easily and inexpensively check if an apartment building is currently listed for sale. It doesn't have to be shoved in their face but there should be some route available to find out. For all the owner knows, maybe some tenant in the building will come into an inheritance and want to buy it!

As rents continue to increase and the size of the rent-burdened population grows, the need for more data to help inform renters about the condition of their buildings and caliber of the owners becomes proportionately more intense. It is a fine line to walk between research and an invasion of privacy. Some of these data sources will not open up while the modern lawsuit-happy approach to life remains part of the US zeitgeist. If enough pressure is brought to bear on the door of a private storage area, eventually that door will open. Perhaps the same holds true for private data warehouses as well.